“Crypto Currency Market Dynamics: Understanding PEG, Fees and Positions”

The cryptocurrency market is known for its high volatility and rapid price fluctuations, making it a thrilling space to invest in. However, navigating this market requires a deep understanding of the various components that contribute to its dynamics.

At the heart of any cryptocurrency exchange is the currency peg, also known as the “peg rate.” A currency peg is a fixed exchange rate between two currencies, ensuring that the value of one currency remains stable relative to another. For instance, Bitcoin and US dollars are often pegged at 1:1, meaning that $100 in Bitcoin is equivalent to $100 in USD.

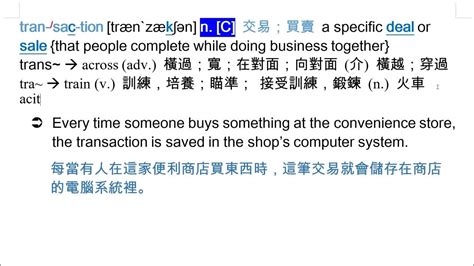

However, the price stability provided by a currency peg can be disrupted when cryptocurrency exchanges impose transaction fees. Transaction fees represent the cost of processing each transaction on an exchange, which can eat into the profitability of buying and selling cryptocurrencies. For example, if you buy 1,000 units of Bitcoin at $10,000 per unit and then sell them for $5,000 after paying a $200 transaction fee, your net profit would be minus $300.

One common strategy used by traders is to take long positions on cryptocurrencies, betting that the price will rise. A long position involves buying an asset with the expectation of selling it in the future at a higher price. For instance, if you believe Bitcoin’s price will increase and buy 1,000 units initially at $10,000 per unit, you’ll sell them for $15,000 after six months to make a profit.

To illustrate this strategy, let’s consider an example of long buying and holding:

- Initial investment: $100,000

- Position size: 1,000 units

- Long position (buying): Buy 1,000 units of Bitcoin at $10,000 per unit initially.

- Expected price increase: $5,000 (a 50% increase)

- Selling point: Sell 1,000 units for $15,000 after six months.

In this scenario, your net profit would be $3,500 ($15,000 – $11,500).

Understanding Currency Pegs and Fees

While a currency peg can provide stability to the cryptocurrency market, it’s essential to understand that even with a fixed exchange rate, prices can still fluctuate. This volatility is partly due to external factors like global events, economic conditions, and supply-demand imbalances.

Similarly, transaction fees can significantly impact an individual’s profitability when trading cryptocurrencies. The more you trade, the higher your transaction fee will be.

To mitigate these risks, traders often employ various strategies, including:

- Diversification: Spreading investments across different assets to reduce reliance on a single market or strategy.

- Stop-loss orders: Setting limits for potential losses in case prices move against you.

- Hedging strategies:

Using derivatives like futures contracts to lock in positions and protect against price fluctuations.

In conclusion, the cryptocurrency market is driven by complex dynamics involving currency pegs, transaction fees, and trading strategies. Understanding these factors can help traders navigate the space more effectively, but it’s crucial to maintain a balanced approach, diversifying investments and managing risk carefully.

Remember, investing in cryptocurrencies carries inherent risks, including price volatility, regulatory changes, and market manipulation. Always conduct thorough research, set clear goals, and never invest more than you can afford to lose.