“laughs everything in BNB: Binance Coin (BNB) and short positions in the encryption market”

As the cryptocurrency world develops even more, traders and investors are increasingly impressed by the potential of digital devices such as Bitcoin (BTC), Ethereum (ETH) and others. One of the popular strategies that are attracted to is the short sale -the way you get the price of the device buying -o at a low point and selling it at a higher point, hoping to profit from the difference.

One of the cryptocurrencies, which was particularly popular with short positions, is the binance coin (BNB). Because Binance is a native cryptocurrency, one of the largest and most popular cryptocurrency on the market, BNB has become many fired shorts for sale. But before the world of encryption trade begins, it is essential to understand how to use and make good decisions.

What is the coin tracker?

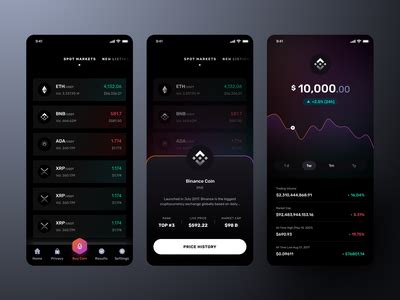

Coin’s tracker is an on -line device that allows users to monitor the price and performance of multiple real -time cryptocurrencies. These platforms usually provide detailed statistics, including daily height and low points, market capitalization and negotiation. Using a currency tracker, traders can get a fast krypto market instantaneous and modify them based on their strategy.

Coin Binance (BNB) explained

Binance’s currency is Binance’s native cryptocurrency, one of the world’s largest cryptocurrencies. Launched in 2017, BNB quickly became a popular choice among traders due to low transaction rates, high negotiation and widespread use.

As the second largest cryptocurrency after Bitcoin is market capitalization, BNB is often used as inflation assessment and coverage. This is also used for various binance ecosystem transactions, including the purchase and sale of other cryptocurrencies, the payment of gas fees when the transaction is continued on the platform and so on.

Short Position: High Risk Strategy

A uncovered sale is a way to bet on the price of a device buying -at a low point and selling it at a higher point. In case of proper execution, a discovered sale may be a profitable strategy, but there are significant risks. If the market moves in the opposite of the trader’s expectations, they will suffer from losses in their short position.

How to make an effective short position

To achieve an effective short position:

- Choose a cryptocurrency : Choose a cryptocurrency that has shown strong volatility and probably move against trade.

- Set the stop standing level : Determine how willing to lose trade if you set up a stop interval level at a predetermined price. This helps to limit possible losses when the market goes in the wrong direction.

- Use a reputation for reputation : Use a well -established cryptocurrency exchange, such as Binance, which offers robust trade tools and low loads.

- Listen to the tight market : Observe the market and adjust the negotiation, if necessary, to remain at the loser level.

Example of using the currency in a short position

Suppose you have chosen Ethereum (ETH) from cryptocurrency in a short position. He uses a tracker to monitor the price of ETH and finds that it has decreased significantly in recent days.

* INITIAL PRICE : $ 4000.00

* LOSS PARADE LEVEL

: 3500.00 USD

When waiting for new developments, you make the first negotiation by buying US $ 4500 (your entry price) and selling it to $ 3750.00 (stop level). The profit is approx. US $ 300.00 / ETH, leading to $ 12,000 in total.

However, if the market moves against you and the Ethi prices rise above the stop level, they will suffer losses in a short position. If you stay at the range level, you will make a profit of $ 300.00 per eth.