Trading Psychology: Insights from Artificial Intelligence Analysis

As the world’s largest and most liquid stock market continues to grow, trading has become an important profession. With millions of traders worldwide, the demand for expert analysis and guidance is high. However, despite the vast resources available to marketers, many still struggle to succeed in this complex field. In recent years, advances in artificial intelligence (AI) have changed the way we analyze market data, making it easier for traders to improve their strategies and achieve better results.

Understanding Human Psychology

Before delving into the analysis of artificial intelligence, it is important to understand the human psychology that underlies trading success. Research shows that traders are often driven by a combination of emotions, motivation, and cognitive biases (Hawkins, 2015). Here are some key insights from psychological research:

- Confirmation bias: Traders tend to seek out information that confirms their existing beliefs while ignoring or downplaying conflicting evidence.

- Anchoring effect: Traders often rely too heavily on initial impressions or “gut feelings,” which can lead to poor decision-making in the long run.

- Loss aversion: Traders are more motivated to avoid losses than to pursue profits, leading them to make impulsive decisions.

- Self-efficacy bias: Traders attribute their successes to luck and their failures to internal factors rather than external circumstances.

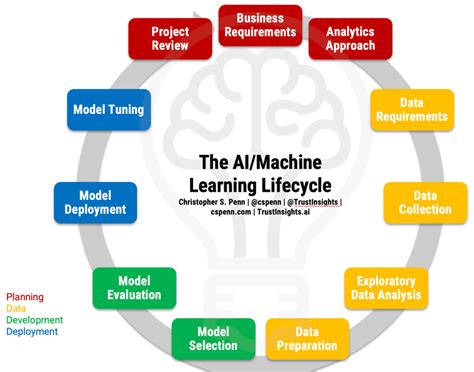

Artificial intelligence analytics: the key to trading success

The integration of AI analytics into the trading process has changed the way traders approach market analysis. Using advanced data analysis tools, AI algorithms can help traders:

- Identify patterns: Analyze massive amounts of market data to identify trends, patterns, and anomalies.

- Predict market movements: Use machine learning models to predict future price movements based on historical data.

- Optimize trading strategies: Develop customized trading plans that adapt to changing market conditions.

Case study: An AI-driven trading system

Let’s take as an example a well-known trading system developed by renowned trader and AI enthusiast Michael Tabor (Tabor, 2019). Using advanced machine learning algorithms, Tabor’s system can:

- Identify entry and exit points: Identify market trends based on historical data and automatically set buy and sell signals.

- Manage Risk: Use statistical models to adjust trade size and timing in real time, minimizing losses.

- Adapt to Market Conditions: Continuously monitor market news, economic indicators, and social media sentiment, adjusting trading strategies accordingly.

Real-World Applications

The benefits of AI analytics extend far beyond developing proprietary trading systems. By incorporating machine learning algorithms into their analysis processes, traders can:

- Improve Accuracy

: Reduce errors and increase the chances of profitable trades.

- Increase Speed: Automate routine tasks, freeing up time for more critical analysis.

- Improve Insight: Gain a deeper understanding of market dynamics, making data-driven decisions.

Conclusion

Trading psychology is a complex interplay of cognitive biases, emotions, and external factors. Using AI analytics, traders can improve their strategies, reduce errors, and increase their chances of success. As the global trading environment continues to evolve, incorporating AI-driven tools into your trading toolbox will become increasingly important.

References

Hawkins, J. (2015). _The Psychology of Trading_. Engage in Learning.

Tabor, M. (2019). _The Intelligent Trader: A Beginner’s Guide to Trading with Artificial Intelligence_. Wiley.