“Cryptocurrency Market Alert: Understanding Bybit and Its PopCat Strategy”

The cryptocurrency market has become increasingly volatile in recent times, with prices fluctuating wildly on a daily basis. To navigate this uncertainty, traders and investors need to have a solid understanding of various strategies and tools used to manage risk. One popular strategy that has gained traction is the use of stop-loss orders, particularly when paired with certain cryptocurrencies like Popcat (POPCAT).

What is Crypto?

Crypto, short for cryptocurrency, refers to digital currencies that use cryptography for secure financial transactions and control the creation of new units. These digital assets are decentralized, meaning they’re not controlled by any government or institution, and operate independently through complex algorithms. The most well-known cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

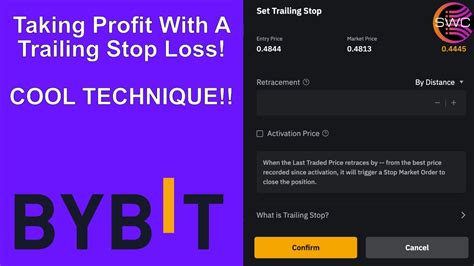

Bybit: A Leading Cryptocurrency Exchange

Bybit is a popular cryptocurrency exchange that offers a wide range of trading pairs, including major fiat currencies like USD, EUR, and JPY. Launched in 2018, ByBit has gained significant traction among traders due to its low fees, fast transaction processing times, and user-friendly interface.

Popcat (POPCAT) Strategy

The Popcat strategy involves using a stop-loss order on cryptocurrencies that you’re trading with the intention of limiting potential losses. This can be particularly useful when dealing with volatile assets like Bitcoin (BTC), which has experienced significant price swings in recent years. By setting a stop-loss level, you can lock in profits or limit your losses if the market moves against you.

Here’s an example of how to use Popcat on Bybit:

- Open your Bybit account and set up a trading pair.

- Choose a cryptocurrency that you’re interested in trading, such as BTC.

- Set a stop-loss level (e.g., 5% loss) above your desired profit target (e.g., $100).

- Place the trade on Bybit with the specified settings.

The Benefits of Popcat

Using Popcat on Bybit can be beneficial for several reasons:

- Risk management: By setting a stop-loss level, you can limit potential losses and lock in profits.

- Profit protection

: If the market moves against you, the stop-loss order will automatically trigger and lock in your profit.

- Increased trading volume: Bybit offers fast transaction processing times, which can result in increased trading volumes and more opportunities to trade.

The Risks of Popcat

While the Popcat strategy can be effective, there are also potential risks to consider:

- Slippage: If the stop-loss order is triggered too early or too late, it can lead to slippage (additional fees for a faster-than-expected transaction).

- Market volatility: Cryptocurrency markets are inherently volatile, and prices may fluctuate rapidly.

- Exchange fees: Bybit charges relatively low fees compared to other exchanges, but these fees can add up quickly.

Conclusion

Cryptocurrency markets can be unpredictable, and it’s essential for traders and investors to have a solid understanding of various strategies and tools used to manage risk. The Popcat strategy on Bybit offers a convenient way to limit potential losses while still profiting from trades that you initiate with the intention of trading. However, it’s crucial to weigh the benefits against the risks and use this strategy judiciously.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies carries significant risks, including the possibility of losing your entire investment. Always do thorough research and consult with a financial advisor before making any investment decisions.